At Jobinvietnam.net, we understand that navigating the complex world of taxes can be daunting, especially for foreigners working in Vietnam. That’s why we’ve put together this comprehensive guide to help you understand the various tax deductions and allowances available to individuals in Vietnam. By taking advantage of these benefits, you can reduce your taxable income and keep more of your hard-earned money in your pocket.

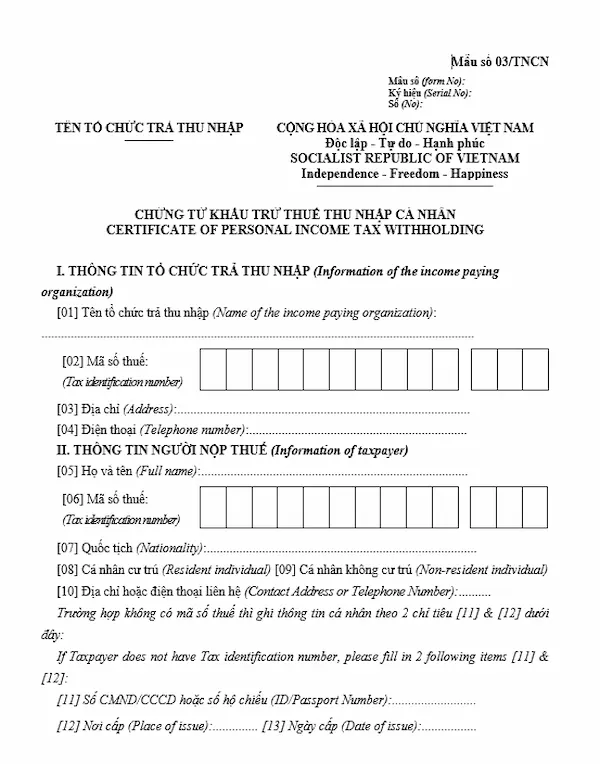

Personal Income Tax (PIT) Deductions

Vietnam’s tax system allows for several deductions that can significantly reduce your taxable income. Here are some of the most common PIT deductions:

- Social Insurance, Health Insurance, and Unemployment Insurance Contributions: Mandatory contributions to these insurance schemes are fully deductible from your taxable income.

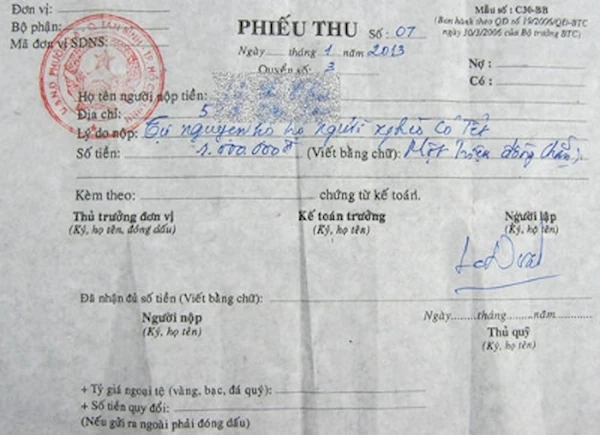

- Charitable Contributions: Donations to government-approved charitable organizations are deductible, provided you have proper documentation.

- Business Expenses: If you’re self-employed or running a small business, you can deduct legitimate business expenses from your taxable income.

Personal Allowances

In addition to deductions, Vietnam’s tax system provides personal allowances based on your circumstances. These allowances reduce your taxable income, and the amount varies depending on factors such as your residency status and the number of dependents you have.

Personal Allowance for Residents

If you’re a tax resident in Vietnam, you’re entitled to a personal allowance of VND 11 million per month (VND 132 million per year). This allowance is automatically applied when calculating your taxable income.

Personal Allowance for Non-Residents

Non-residents are not eligible for the standard personal allowance. However, they may be able to claim deductions for mandatory insurance contributions and charitable donations.

Dependent Allowances

If you have dependents, such as children or elderly parents, you may be eligible for additional allowances. The dependent allowance is VND 4.4 million per month (VND 52.8 million per year) for each eligible dependent.

To claim the dependent allowance, you must meet the following criteria:

- The dependent must be a direct relative, such as a child, spouse, parent, or sibling.

- The dependent must have an income below the threshold set by the government.

- You must provide proof of your financial support for the dependent.

Maximizing Your Tax Savings

To make the most of these tax deductions and allowances, it’s essential to keep accurate records and provide proper documentation when filing your taxes. This includes receipts for charitable donations, business expenses, and proof of dependent eligibility.

By understanding and utilizing these tax benefits, you can significantly reduce your taxable income and minimize your tax liability. However, navigating Vietnam’s tax system can be complex, especially for foreigners.

That’s where Jobinvietnam.net comes in. Our team of experts is here to help you not only find the best employment opportunities in Vietnam but also to guide you through the intricacies of the tax system. We’re committed to ensuring that you have the information and support you need to thrive in your career and maximize your financial well-being.

Don’t hesitate to reach out to us via phone, Zalo, or WhatsApp for personalized advice and guidance on tax deductions, allowances, and any other aspects of working in Vietnam. We’re here to help you every step of the way.

Tax Filing Procedures and Deadlines in Vietnam

When it comes to tax filing procedures in Vietnam, there are a few key steps that individuals need to follow. First and foremost, you’ll need to register for a tax code with your local tax office. This is a crucial step that ensures you’re properly identified within the tax system.

Once you have your tax code, you’ll need to submit your Personal Income Tax (PIT) declarations on a monthly or quarterly basis, depending on your income and employment situation. Along with these declarations, you’ll also need to make the necessary tax payments to fulfill your obligations.

At the end of the tax year, you’ll be required to file an annual PIT finalization return. This is where you’ll reconcile your tax payments made throughout the year and settle any outstanding tax liabilities.

Now, let’s talk about the deadlines for these tax filing procedures. For monthly PIT declarations, you’ll need to submit them by the 20th of the following month. If you’re filing quarterly PIT declarations, the deadline is the 30th of the first month of the following quarter.

When it comes to the annual PIT finalization, the deadline is typically the last day of the third month after the end of the calendar year, which usually falls on March 31st.

It’s important to note that if you’re an employee, your employer will usually handle the process of withholding PIT from your salary and remitting it to the tax authorities on your behalf. However, if you’re earning income from other sources, such as freelance work or investments, you’ll be responsible for filing and paying your taxes yourself.

Failing to comply with these tax filing procedures and deadlines can result in some serious consequences, including penalties and interest charges. That’s why it’s so important to stay on top of your tax obligations and ensure you’re meeting all the necessary requirements.

If you’re feeling overwhelmed or unsure about your tax filing responsibilities, don’t hesitate to seek professional advice. A qualified tax consultant can provide valuable guidance and support to help you navigate the complexities of the Vietnamese tax system.

At Jobinvietnam.net, we understand that taxes can be a daunting subject, especially for foreigners working in Vietnam. That’s why we’ve put together a comprehensive guide on tax filing procedures and deadlines, which you can access by click here to learn more about: Tax Filing Procedures and Deadlines in Vietnam

Remember, taking control of your tax obligations is an essential part of your financial well-being. By understanding the tax filing procedures and deadlines in Vietnam and seeking the right support when needed, you can ensure a smooth and stress-free tax filing experience.

Vietnam Income Tax Rates for Individuals and Businesses