Social Security and Insurance for Expats in Vietnam

Are you an expat living and working in Vietnam? It’s important to understand the social security and insurance options available to you. In this article, we’ll dive into the details of what you need to know to stay protected while enjoying your time in this vibrant country.

Social Security in Vietnam

Vietnam has a social security system that covers both Vietnamese citizens and foreign workers. As an expat, you are required to contribute to the social security fund if you have a work permit and labor contract with a Vietnamese company.

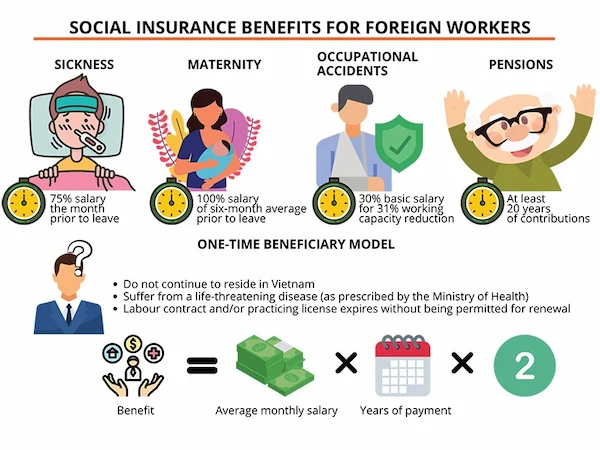

The social security fund provides benefits such as:

- Retirement pensions

- Survivor allowances

- Sick leave

- Maternity leave

- Work-related accident and occupational disease benefits

Contribution Rates

Both employers and employees contribute to the social security fund. As of 2023, the contribution rates are:

| Contributor | Social Insurance | Health Insurance | Unemployment Insurance | Total |

| Employer | 17.5% | 3% | 1% | 21.5% |

| Employee | 8% | 1.5% | 1% | 10.5% |

These contributions are calculated based on your gross monthly salary, up to a maximum of 20 times the minimum wage set by the government.

It’s important to note that foreign workers are required to contribute to the social security fund for the duration of their employment contract in Vietnam. Your employer will handle the registration and monthly contributions on your behalf.

Health Insurance

In addition to the compulsory health insurance under the social security system, many expats in Vietnam opt for private health insurance for more comprehensive coverage. Private health insurance can provide benefits like:

- Coverage at international hospitals and clinics

- Medical evacuation

- Outpatient treatment

- Dental care

- Maternity care

When choosing a private health insurance plan, consider factors such as:

- Coverage limits

- Deductibles and co-payments

- Exclusions and pre-existing conditions

- Provider network

- Repatriation benefits

It’s a good idea to compare plans from different insurers to find the one that best suits your needs and budget. Some popular health insurance providers for expats in Vietnam include:

- Aetna

- Allianz

- Bao Viet

- Cigna

- Pacific Cross

Other Types of Insurance

Aside from social security and health insurance, there are other types of insurance that expats in Vietnam may want to consider:

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover expenses like:

- Funeral costs

- Outstanding debts

- Living expenses for your family

There are two main types of life insurance:

- Term life insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

- Whole life insurance: Provides lifelong coverage and includes a savings component.

Property Insurance

If you own a home or valuable possessions in Vietnam, property insurance can protect them against risks like:

- Fire

- Theft

- Natural disasters

Some common types of property insurance include:

- Homeowners insurance

- Renters insurance

- Valuable items insurance

Travel Insurance

If you frequently travel outside of Vietnam, travel insurance can provide coverage for:

- Trip cancellations or interruptions

- Lost or delayed luggage

- Emergency medical expenses

- Evacuation and repatriation

Many travel insurance policies also include benefits like 24/7 assistance services and concierge services.

Tips for Expats

Here are some tips to help you navigate the world of social security and insurance in Vietnam:

- Understand your obligations: Make sure you understand your social security obligations as an expat worker in Vietnam. Your employer should be able to provide guidance and handle the necessary registrations and contributions.

- Review your insurance needs: Take stock of your insurance needs based on your personal and financial situation. Consider factors like your health, family, assets, and lifestyle when choosing insurance policies.

- Shop around: Don’t settle for the first insurance policy you find. Compare plans from different providers to find the best coverage and value for your money.

- Read the fine print: Before signing up for any insurance policy, make sure you carefully read and understand the terms and conditions, including coverage limits, exclusions, and claims procedures.

- Keep your documents in order: Make sure you have all the necessary documents, such as your social security book and insurance policy documents, in a safe and easily accessible place.

- Stay informed: Keep up with any changes or updates to Vietnam’s social security and insurance regulations that may affect you as an expat.

Conclusion

As an expat in Vietnam, it’s crucial to have a solid understanding of the social security and insurance landscape. By contributing to the social security fund and selecting appropriate insurance policies, you can protect yourself and your loved ones against financial risks and uncertainties.

Remember, everyone’s insurance needs are different, so take the time to assess your situation and choose the coverage that best fits your unique circumstances.

If you have any questions or need assistance with social security or insurance matters in Vietnam, don’t hesitate to reach out to a qualified professional or your employer’s HR department for guidance.

Finally, if you’re looking for a reliable partner for your tempered glass roof construction needs in Vietnam, look no further than Jobinvietnam.net. With their expertise and commitment to quality, you can trust them to deliver outstanding results for your project. Contact Jobinvietnam.net today via phone or Zalo to receive the clearest and most detailed advice for your tempered glass roof requirements.