Recent Tax Reforms and Their Impact on Individuals and Businesses in Vietnam

At Jobinvietnam.net, we understand the significance of staying informed about the latest tax reforms in Vietnam. In this article, we’ll dive into the recent changes and how they affect both individuals and businesses operating in the country.

Overview of the Recent Tax Reforms

Vietnam has undergone several notable tax reforms in recent years, aimed at streamlining the tax system and promoting economic growth. These reforms include:

- Reduction of corporate income tax rates

- Simplification of value-added tax (VAT) regulations

- Introduction of new tax incentives for small and medium-sized enterprises (SMEs)

- Amendments to personal income tax brackets and deductions

Impact on Individuals

for individual taxpayers

The recent tax reforms have brought about several changes that directly impact individuals in Vietnam:

- Personal Income Tax (PIT) Adjustments: The reforms have revised the PIT brackets, increasing the tax-exempt threshold and adjusting the tax rates for various income levels. This means that many individuals may now have a lower tax burden, allowing them to retain more of their hard-earned money.

- Deductions and Allowances: The reforms have also introduced new deductions and allowances, such as increased deductions for dependent family members and more generous allowances for work-related expenses. These changes can help reduce the taxable income for individuals.

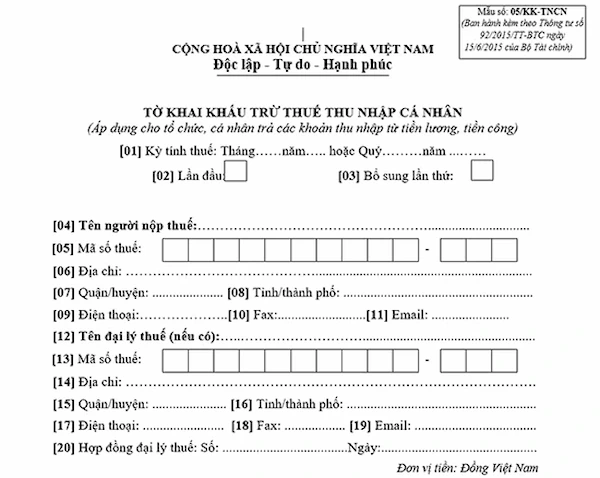

- Simplified Tax Filing: The government has made efforts to simplify the tax filing process for individuals, with the introduction of online filing systems and more user-friendly forms. This makes it easier for taxpayers to comply with their tax obligations.

Impact on Businesses

The tax reforms have also brought significant changes for businesses operating in Vietnam:

| Reform | Impact |

| Reduced Corporate Income Tax Rates | Lower tax rates can help businesses retain more profits and invest in growth and expansion. |

| Simplified VAT Regulations | Streamlined VAT rules can reduce compliance costs and make it easier for businesses to manage their tax affairs. |

| Tax Incentives for SMEs | New incentives can help SMEs to thrive and compete more effectively in the market. |

| Improved Tax Administration | Efforts to modernize and digitize tax administration can reduce bureaucracy and make it easier to do business. |

These reforms are intended to create a more business-friendly environment, encouraging investment and entrepreneurship in Vietnam.

Navigating the Changes

While the recent tax reforms bring many benefits, they can also create challenges for those unfamiliar with the new regulations. At Jobinvietnam.net, we recommend seeking professional advice to ensure that you fully understand your tax obligations and can take advantage of any available incentives or deductions.

It’s also essential to stay up-to-date with any further changes or clarifications issued by the tax authorities. By staying informed and proactive, you can navigate the tax landscape with confidence and make the most of the opportunities presented by the reforms.

Digital Tax in Vietnam

to comply with tax obligations

Vietnam has recently introduced new regulations on digital tax, which aim to ensure that businesses operating in the digital economy pay their fair share of taxes. These regulations apply to e-commerce platforms, online advertising, and other digital services.

Under the new rules, foreign companies providing digital services to customers in Vietnam are required to register for VAT and pay taxes on their revenue earned in the country. This includes giants like Google, Facebook, and Amazon, as well as smaller players in the digital space.

The introduction of digital tax regulations is part of Vietnam’s broader efforts to modernize its tax system and keep pace with the rapidly evolving digital economy. By ensuring that all businesses, regardless of their location or size, contribute to the country’s tax base, Vietnam aims to create a more level playing field and generate additional revenue for public services.

For more information on the implications of digital tax in Vietnam, read our in-depth article on the topic: [Insert link to article on: Digital Tax in Vietnam: What You Need to Know

Conclusion

The recent tax reforms in Vietnam have brought about significant changes for both individuals and businesses. By understanding these changes and their implications, you can make informed decisions and take advantage of the opportunities they present.

At Jobinvietnam.net, we’re committed to providing valuable insights and guidance to help you navigate the complex world of taxes in Vietnam. If you have any questions or need assistance, don’t hesitate to reach out to our team of experts via phone, Zalo, or WhatsApp. We’re here to help you succeed in your career and business endeavors in Vietnam.