Tax Incentives and Exemptions for Businesses in Vietnam

At Jobinvietnam.net, we understand that navigating the complex world of tax incentives and exemptions can be daunting for businesses operating in Vietnam. That’s why we’ve put together this comprehensive guide to help you make sense of it all.

Understanding the Basics

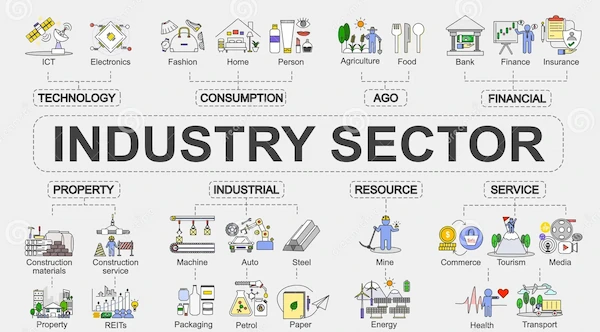

Vietnam offers a range of tax incentives and exemptions to attract foreign investment and support domestic businesses. These benefits vary depending on factors such as:

- Industry sector

- Location of investment

- Scale of investment

- Duration of investment

It’s crucial to understand the eligibility criteria and application processes to take full advantage of these incentives.

Corporate Income Tax (CIT) Incentives

income tax by 10%

One of the most significant tax benefits for businesses in Vietnam is the reduced CIT rate. The standard CIT rate is 20%, but qualifying projects can enjoy lower rates:

| Investment Location | CIT Rate | Duration |

| High-tech zones, economic zones, and difficult socio-economic areas | 10% | 15 years |

| Industrial parks and other encouraged sectors | 17% | 10 years |

After the preferential period, the CIT rate reverts to the standard 20%.

CIT Exemptions and Reductions

then 50% reduction for 9 years

In addition to reduced CIT rates, businesses may also qualify for CIT exemptions and reductions. For example:

- Projects in high-tech zones, economic zones, and difficult socio-economic areas are eligible for a 4-year CIT exemption followed by a 9-year 50% reduction.

- Projects in industrial parks and other encouraged sectors are eligible for a 2-year CIT exemption followed by a 4-year 50% reduction.

These exemptions and reductions can significantly lower your tax burden, especially in the early years of operation.

Import Duty Exemptions

explore Vietnam’s policy

Vietnam also offers import duty exemptions on certain goods, such as:

- Raw materials, components, and supplies used for export production

- Machinery, equipment, and specialized means of transport directly serving production activities

- Goods imported for scientific research and technological development purposes

By taking advantage of these exemptions, businesses can reduce their costs and improve their competitiveness in the global market.

Land Rental Incentives

Land rental is another area where businesses can benefit from incentives. Depending on the location and sector of investment, projects may be eligible for:

- Land rental exemptions for a certain period

- Reduced land rental rates

- Waived land use fees

These incentives can help businesses secure prime locations for their operations while minimizing their land-related expenses.

Maximizing Your Benefits

To make the most of these tax incentives and exemptions, it’s essential to:

- Thoroughly research the available benefits and their eligibility criteria

- Carefully structure your investment to optimize your tax position

- Engage with experienced tax professionals who can guide you through the application process

- Maintain accurate records and comply with all reporting requirements

At Jobinvietnam.net, we’re here to help you every step of the way. Our team of experts can provide personalized advice and support to ensure that your business takes full advantage of the tax benefits available in Vietnam.

Double Taxation Agreements and Their Impact on Vietnam

Vietnam has entered into double taxation agreements (DTAs) with over 70 countries worldwide. These agreements are designed to prevent double taxation and promote cross-border trade and investment. Under a DTA, a company or individual who is a resident of one contracting state and derives income from the other contracting state may be taxed in either state, but not both. This helps to eliminate the burden of double taxation and provides greater certainty for businesses operating in multiple jurisdictions. DTAs also typically include provisions for the exchange of information between tax authorities to combat tax evasion and avoidance. As Vietnam continues to expand its network of DTAs, businesses can expect to benefit from reduced tax barriers and increased opportunities for international growth. Read more about: Double Taxation Agreements and their impact on Vietnam.