Determining Tax Residency in Vietnam

Jobinvietnam.net is here to help you navigate the ins and outs of tax residency in Vietnam. It’s a tricky subject, but we’ll break it down nice and simple. Because when it comes to taxes, nobody wants any surprises.

What Makes You a Tax Resident?

Vietnam has specific criteria that determine whether you’re considered a tax resident:

- You have a permanent residence in Vietnam

- You’ve been physically present in Vietnam for 183 days or more in a calendar year or 12 consecutive months

- You have a temporary residence in Vietnam and generate income in the country

Meet any one of those conditions and congratulations – you’re a tax resident of Vietnam! But what does that really mean for you and your wallet? Let’s take a closer look.

Obligations of Tax Residents

As a tax resident, you have some financial responsibilities to fulfill:

| Obligation | Description |

| Personal Income Tax (PIT) | You must pay PIT on your worldwide income |

| Social Insurance | You’re required to contribute to social, health, and unemployment insurance |

| Tax Declaration | You must declare your income and pay taxes according to Vietnam’s regulations |

It may seem like a lot, but these obligations ensure that everyone contributes their fair share to keep Vietnam’s economy running smoothly. And trust us, it’s better to stay on top of your taxes than to face the consequences later on.

Benefits of Being a Tax Resident

Now, it’s not all obligations and no perks. As a tax resident, you’re entitled to certain benefits:

- Access to public healthcare services

- Eligibility for social welfare programs

- Ability to invest in and own property in Vietnam

So while you may have to pay taxes, you also get to enjoy the advantages of being a part of Vietnam’s society and economy. It’s a give and take, just like any good relationship.

Determining Your Tax Residency Status

So, how do you know if you’re a tax resident or not? Here’s a step-by-step guide:

- Check your physical presence: Have you been in Vietnam for 183 days or more in a calendar year or 12 consecutive months? If yes, you’re a tax resident.

- Review your residence status: Do you have a permanent or temporary residence in Vietnam? If permanent, you’re a tax resident. If temporary and you generate income in Vietnam, you’re also a tax resident.

- Assess your income sources: Do you earn income from Vietnamese sources? If yes, and you meet either the physical presence or residence criteria, you’re a tax resident.

It’s essential to accurately determine your tax residency status to avoid any legal issues or penalties. When in doubt, consult with a tax professional or reach out to Jobinvietnam.net for guidance.

Double Taxation Agreements

What if you’re a tax resident of Vietnam but also have tax obligations in another country? That’s where double taxation agreements (DTAs) come into play. Vietnam has DTAs with many countries to prevent double taxation on the same income.

If you’re a tax resident of a country that has a DTA with Vietnam, you may be eligible for tax exemptions or reduced tax rates on certain types of income. It’s crucial to review the specific DTA between Vietnam and your other country of tax residence to understand your rights and obligations.

Consequences of Non-Compliance

Failing to comply with Vietnam’s tax regulations can lead to serious consequences:

- Fines and penalties for late or incorrect tax declarations

- Legal action for tax evasion

- Difficulty in obtaining visas or work permits

- Damage to your reputation and credibility

It’s not worth the risk. Stay compliant, stay safe, and stay on the right side of the law.

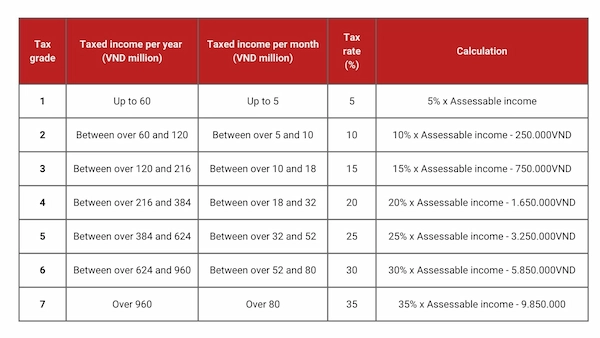

Vietnam Income Tax Rates for Individuals and Businesses

Vietnam has a progressive personal income tax system, with rates ranging from 5% to 35% depending on your income level. For businesses, the corporate income tax rate is generally 20%, although certain sectors and industries may be subject to different rates.

It’s essential to understand the specific tax rates applicable to your situation to ensure accurate tax planning and compliance. Jobinvietnam.net can help you navigate the complexities of Vietnam’s tax system and optimize your tax strategy. Don’t let taxes hold you back from achieving your goals in Vietnam. Take control of your finances and thrive in this dynamic and exciting country.

To learn more about Vietnam’s income tax rates for individuals and businesses, click here to read more about: Vietnam Income Tax Rates for Individuals and Businesses

Contact Jobinvietnam.net today via phone, Zalo, or WhatsApp for personalized assistance in understanding and fulfilling your tax obligations in Vietnam. Our expert team is here to help you succeed.